[PDF] Social Security Legislation Tax Credits And HMRCAdministered Social Security Benefits Ebook

Wildy Amp Sons Ltd The World S Legal Bookshop Search Results For Isbn 9780414064102

Chart Book Social Security Disability Insurance Center On Budget And Policy Priorities

Social security income What is income How do tax ... Tax Credits: Social security income. Claimants may be eligible for more than one WSP if applicable. These are awarded automatically and there is no need to claim them. The broad principle is that the tax - and therefore tax credit - treatment of a WSP paid by the NI Executive follows the tax (and tax credit) treatment of whichever social security benefit they are topping up. Social Security Legislation 2018/19, Volume IV: Tax ... Specifically, the volumes interpret the legislation for the purpose of appeals against decisions about benefit claims, which are held in Social Security Tribunal hearings. This volume is a one stop shop for tax credits, containing the relevant Acts and regulations, administrative and procedural issues, and provisions governing tribunals, with commentary. What Are the Social Security Changes in 2019? - aarp.org Work credit earnings rise. The earnings required for one work credit that is, three months of Social Security coverage edges up from $1,320 to $1,360 for 2019. Credits are the building blocks the Social Security Administration uses to determine whether you qualify for benefits. You can earn up to four credits a year if you earn at least ...

Does Payroll Tax Fica Cover All Of Social Security And Medicare Programs Quora

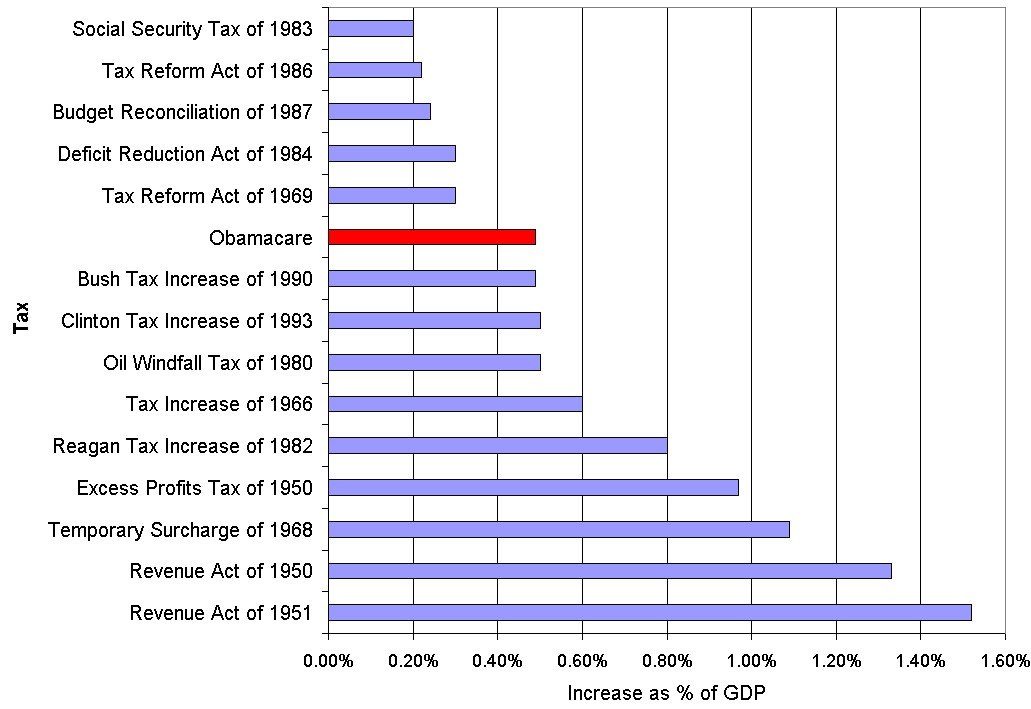

Obamacare Is The Biggest Tax Increase In History If You Ignore History The Incidental Economist

Three Revenue Options To Shore Up Social Security Center On Budget And Policy Priorities

0 Response to "Social Security Legislation Tax Credits And HMRCAdministered Social Security Benefits"

Post a Comment